A Quick Theory on the Pass-Through Premium at the Level of Control

By Joshua B. Angell

Introduction

There is a general consensus among appraisers that a controlling ownership interest in a pass-through firm should not be worth much more than a controlling ownership interest in an otherwise identical double-tax firm. This “general consensus” primarily stems from empirical studies that have compared the pricing multiples of pass-through firms to that of double-tax firms in the market for control. For example, in a recent study of the Pratt’s Stats Database, the author of this post compared the pricing multiples of over 7,000 market transactions and found very weak, if any, statistical evidence in support of a pass-through premium in the market for controlling ownership interests. As such, many appraisers have concluded that a pass-through premium should not apply when determining the fair market value of a controlling ownership interest in a pass-through firm.

Despite the empirical evidence, however, appraisers should understand that a controlling ownership interest in a pass-through firm can theoretically command (and investors should be willing to pay) a price premium, price discount, or even no pricing differential relative to an otherwise identical controlling ownership interest in a double tax firm. The purpose of this article is to demonstrate this concept and highlight the primary economic factors that contribute to the pass-through premium at the enterprise level.

A Theoretical Model for the Pass-Through Premium

To understand why the pass-through premium can be positive, negative, or non-existent, we begin with a basic formula for valuing the after-tax cash flows of a pass-through firm from the perspective of the investor (we assume the investor maintains the pass-through election):

ValuePT = EBTPT*(1-RPT-Tp) / (KatPT-GatPT)

Where:

EBTPT = Earnings before tax of pass-through firm, next year

Tc = Corporate income tax rate

RPT = Reinvestment ratio expressed as a percentage of EBTPT

Td = Dividend tax rate

KatPT = After-shareholder level tax cost of capital

GatPT = Long-term sustainable growth rate in free cash flow

This formula is effectively the Gordon Growth Model for a pass-through firm. The numerator, EBTPT*(1-RPT-Tp), represents the after-tax cash flow available to the investor after all taxes, including personal taxes, have been paid. The denominator is the after-tax capitalization rate applicable to this income stream. Therefore, KatPT, is the after-shareholder level tax discount rate. This rate differs from the rate that an appraiser would obtain from a source such as Ibbotson. Nonetheless, this equation values the perpetual income stream of a pass-through entity from the perspective of an investor who plans to maintain the pass-through election into perpetuity.

Next, we extend this same underlying concept to a double tax firm:

ValueDT = EBTDT*(1-Tc-RDT)*(1-Td) / (KatDT-GatDT)

Where:

EBTDT = Earnings before tax of double-tax firm, next year

Tc = Corporate income tax rate

RDT = Reinvestment ratio expressed as a percentage of EBTDT

Td = Dividend tax rate

KatDT = After-shareholder level tax cost of capital

GatDT = Long-term sustainable growth rate in free cash flow

This formula is effectively the Gordon Growth Model for a double tax firm (as customarily defined in most investment textbooks), except we deduct dividend taxes, (i.e. 1-Td) from corporate free cash flow (i.e. EBTDT*(1-Tc-RDT). We deduct dividend taxes from corporate free cash flow in order to obtain the actual cash flows available to the investor after all taxes, including personal taxes, have been paid. Therefore, the discount rate, KatDT, is, again, the after-shareholder level tax discount rate, and not the pre-shareholder level tax discount rate that one would obtain from a source such as Ibbotson. In our opinion, this method is more theoretically appealing than using pre-tax rates. Nonetheless, this equation values the perpetual income stream available to an investor in a double-tax firm, assuming the investor maintains the double-tax status of the firm into perpetuity.

Finally, to determine theoretical pass-through premium percentage, (PTP %), we express equation 1 (i.e. the value of pass-through firm) as a percentage of equation 2 (i.e. the value of a double-tax firm) and subtract 1 as follows:

PTP (%) = [EBTPT*(1-RPT-Tp)/(KatPT-GatPT) * (KatDT-GatDT)/EBTDT*(1-Tc-RDT)*(1-Td)] -1

Where:

EBTPT = Earnings before tax of pass-through firm, next year

EBTDT = Earnings before tax of double-tax firm, next year

RPT = Reinvestment rate of pass-through firm, expressed as a % of EBT

RDT = Reinvestment rate of double-tax firm, expressed as a % of EBT

Tp = Effective personal income tax rate

Tc = Effective corporate income tax rate

Td = Effective dividend tax rate

KatPT = After-shareholder level tax return of pass-through firm

KatDT = After-shareholder level tax return of double-tax firm

GatPT = Long-term sustainable growth rate of pass-through firm

GatDT = Long-term sustainable growth rate of double-tax firm

This equation is a mathematical identity that relates the value of a pass-through firm to the value of a double-tax firm. If we assume that the pass-through firm is identical to the double tax firm in every way except for incorporation status – that is, EBTPT, EBTDT, RPT, RDT, KatPT, KatDT, GatPT, and GatDT, are identical – the equation above simplifies to following mathematical identity:

PTP (%) = (1-RPT-Tp)/[(1-RDT-Tc)*(1-DT)] – 1

Where:

RPT = Reinvestment rate of pass-through, expressed as a % of EBTPT

RDT = Reinvestment arte of double-tax firm, expressed as a % of EBTDT

Tp = Effective personal income tax rate on flow-through income from pass-through

Tc = Effective dividend tax rate on corporate distributions

This equation tells us that the relative pricing of a pass-through firm and an otherwise identical double tax firm depends on only four economic variables:

- The reinvestment rates, RPT and RDT (which equal for identical firms)

- The corporate income tax rate, Tc

- The personal income tax rate, Tp; and

- The dividend tax rate, Td

Exploring the Model in Various Scenarios

The above formula can be utilized to evaluate the economic characteristics of the pass-through premium under various different scenarios. For example, consider the situation in which the corporate income tax rate is equal to the personal income tax rate; that is, Tp equals Tc. In that case, (1-RPT-Tp) and (1-RDT-Tc) cancel, and the PTP (%) simplifies to the following equation:

PTP (%) = 1/ (1-Td) – 1

Where:

Td = Dividend tax rate

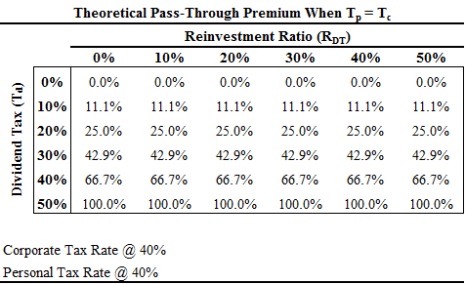

Thus, when personal and corporate income tax rates are identical, the pass-through premium is simply equal to 1 dividend by 1 minus the dividend tax rate, Td, less 1. The table below demonstrates the theoretical pass-through premium under various different dividend tax and reinvestment rate scenarios:

As one can see, when the corporate and personal income tax rate are the same, the pass-through premium is always positive, unless the dividend tax rate is equal to 0%. In addition, the pass-through premium does not depend on the reinvestment rate. Therefore, when corporate and personal tax rates are the same, an investor should be willing to pay a premium for a pass-through firm equal to 1/(1-Td) -1.

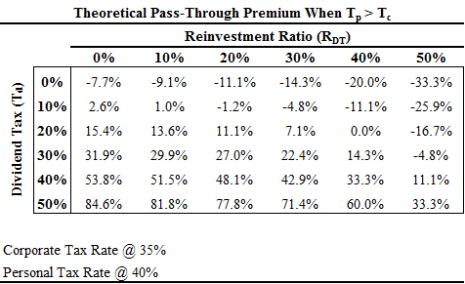

Next, consider the situation in which the personal income tax rate exceeds the corporate income tax rate; that is, Tp > Tc. In this case, the PTP (%) equation cannot simplify any further. However, since RPT and RDT are identical, the numerator will always be smaller than the denominator if Td < 1 – (1-RPT-Tp)/(1-RDT-Tc). Therefore, the PTP (%) can be positive, negative, or zero depending on the corporate income tax rate, the personal income tax rate, the reinvestment ratio and the dividend tax rate. The table below demonstrates this concept assuming a personal income tax rate of 40% and a corporate income tax rate of 35%.

As one can see, the PTP (%) takes several different values depending upon the dividend tax rate and the reinvestment ratio. Several notable observations can be made from the table above. First, notice that the PTP (%) is always positive when the dividend tax rate is greater than 1 – (1-Rpt-Tp)/(1-RDT-Tc). Conversely, the PTP (%) is always negative when the dividend tax rate is less than 1 – (1-Rpt-Tp)/(1-RDT-Tc). Also, notice that the PTP (%) always increases as the dividend tax rate increases. More importantly, notice that the PTP (%) decreases as the reinvestment rate increases; that is, as a firm increases its reinvestment rate the differential in value between a pass-through firm and a double-tax firm declines (assuming the corporate tax rate is below the personal income tax rate). In fact, with the right combination of dividend tax rates and reinvestment ratios a double-tax firm can be worth more than a pass-through firm. The reason is not obvious, but relates to shifting the composition of returns from dividends to capital gains, thereby increasing the after-tax cash flows available to the investor in a double tax firm (*note our model assumes a perpetual holding period, therefore, the present value of capital gains taxes is minimized. For shorter holding periods, however, we would need to consider the capital gains liability. This is outside of the scope of this article). Nonetheless, this shows that when the corporate tax rate is below the personal income tax rate, that a pass-through firm can theoretically command a price premium, price discount, or no-pricing differential relative to an otherwise identical double tax firm.

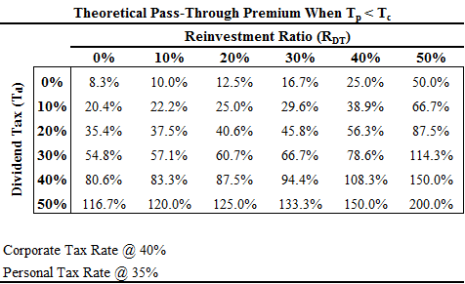

Finally, consider the situation in which the personal income tax rate is below the corporate income tax rate; that is, Tp < Tc. In this scenario, the numerator will always be greater than the denominator. Therefore, the PTP (%) will always be positive, but the magnitude of the PTP (%) will depend upon the dividend tax rate and the reinvestment ratio. This concept is demonstrated in the table below assuming the personal income tax rate is 35% and the corporate income tax rate is 40%.

As one can see, the PTP (%) is positive in all scenarios and is dependent upon the dividend tax rate and the reinvestment ratio. In particular, the PTP (%) increases as both the dividend tax rate and the reinvestment ratio increase. Therefore, if the personal income tax rate is expected to be lower than the corporate income tax rate, an investor should be willing to pay a premium for a pass-through firm, and that premium will vary directly with the dividend tax rate and the reinvestment rate into the firm.

The Break-Even Personal Income Tax Rate

We can also use the PTP (%) formula to determine when an investor will be indifferent between owning a double-tax firm and a pass-through firm (i.e. will pay the same price). For example setting the PTP (%) to zero and solving for the personal tax rate Tp, we discover the following:

Tp = Tc + Td*(1-RDT-Tc)

Where:

Tp = Personal Tax Rate

Tc = Effective Corporate Tax Rate

Td = Effective Dividend Tax Rate

RDT = Reinvestment of pre-tax earnings

Notice that (1-RDT-Tc) is an alternative way of expressing the free cash flow payout ratio, PDT, as as percentage of earnings before tax (EBT). Therefore, an investor will be indifferent from owning a pass-through firm and a double-tax firm when the personal tax rate equals the (a) corporate tax rate plus (b) the dividend tax rate times the free cash flow payout ratio (expressed as a % of pre-tax earnigns). More formally, we can state the following:

- When Tp = Tc + Td*(PDT) the pass-through commands the same price as an otherwise identical double-tax firm

- When Tp > Tc + Td*(PDT) the pass-through commands a discount to an otherwise identical double-tax firm.

- When Tp < Tc + Td*(PDT) the pass-through commands a premium to an otherwise identical double-tax firm.

This demonstrate that the pass-through premium can be positive, negative, or non-existence, depending upon the personal tax rate, the corporate income tax rate, the dividend tax rate, and the reinvestment ratio. Thus, investors purchasing a pass-through firm (an appraisers valuing them) should consider these factors in determining the appropriate price for a pass-through firm.

Conclusions

In this post, I developed a quick theory on the pass-through premium. Using basic financial theory, I show that an investor in a pass-through firm should be willing to pay a price premium, price discount, or no pricing differential relative to an otherwise identical double-tax firm. In particular, the pricing differential will depend upon the corporate income tax rate, the personal income tax rate, the dividend tax rate, and the reinvestment ratio of the firm. I show that when the personal income tax rate is equal to the corporate income tax rate, that an investor should be willing to pay a price premium equal to 1/(1-Td) -1. In addition, I show that when the personal income tax rate exceeds the corporate income tax rate, that the investor should be willing to pay a price premium, price discount, or no-pricing differential depending upon the corporate income tax rate, the personal income tax rate, the dividend tax rate, and the reinvestment ratio. In particular, the investor will pay a premium when the dividend tax rate is greater than 1 – (1-Rpt-Tp)/(1-RDT-Tc). The premium will increase with the dividend tax rate and decline with the reinvestment ratio. In addition, I show that when the personal tax rate is below the corporate tax rate, that the investor should always be willing to pay a premium for a pass-through firm. This premium is positively related to the dividend tax rate and the reinvestment ratio. Finally, I show that investors will be indifferent between owning a pass-through firm and a double-tax firm when. Tp = Tc + Td*(1-RDT-Tc). Appraisers should consider this information when determining the value of a pass-through firm at the level of control.

Author’s Note:

The above analysis rests upon the following assumptions:

1. The pass-through firm is identical to the double-tax firm in every way but for incorporation status

2. The investor maintains the tax status (i.e. pass-through vs. double-tax) of the firm into perpetuity.

3. The investor holds the investment into perpetuity

4. The investor does not take advantage of any favorable tax provisions, such as 338(h)(10) election

5. The corporate income tax rate, personal income tax rate, dividend tax rate, and reinvestment ratio remain constant, forever.

These assumptions are in addition to the assumptions of the Gordon Growth Model that was utilized to develop the underlying formulas. We acknowledge that these assumptions will not always hold up in practice. For example, the buyer may not always be able to maintain the pass-through status (i.e. C-Corp acquiring the S-Corp). Therefore, the buyer may not always pay the full PTP (%). In addition, if investors do not plan to hold an investment into perpetuity, then capital gains taxes would need to be introduced into the equation. This would alter some of the conclusions of my analysis. Nonetheless, the formulas derived in this post demonstrate the complexity in valuing pass-through firms, and show that rational investors can be willing to pay meaningful price premiums and/or price discounts for pass-through firms depending upon the facts of the investment.

Simply desire to say your article is as astounding. The clarity in your post is just nice and i could assume you’re an expert on this subject. Fine with your permission let me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please carry on the enjoyable work.

Appreciate the comment! Feel free to copy the RSS.